Economy

post

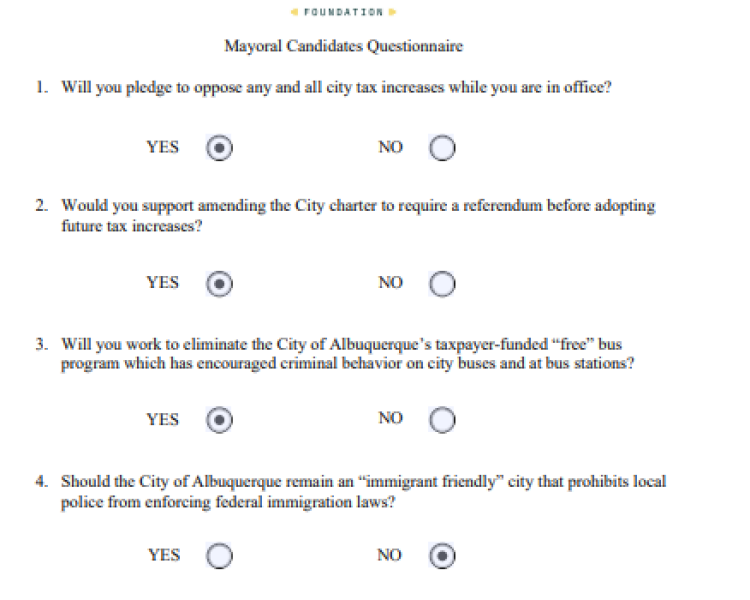

Albuquerque Mayoral Candidate Darren White completes RGF Mayoral candidate survey

07.17.2025

We are pleased to announce that Albuquerque mayoral candidate (former Bernalillo County Sheriff and former…

Crime and homelessness are two of the dominant issues that voters will be considering as…

Learn More

There are many factors that make Gallup a unique place to do business. Paul visits…

Learn More

See More