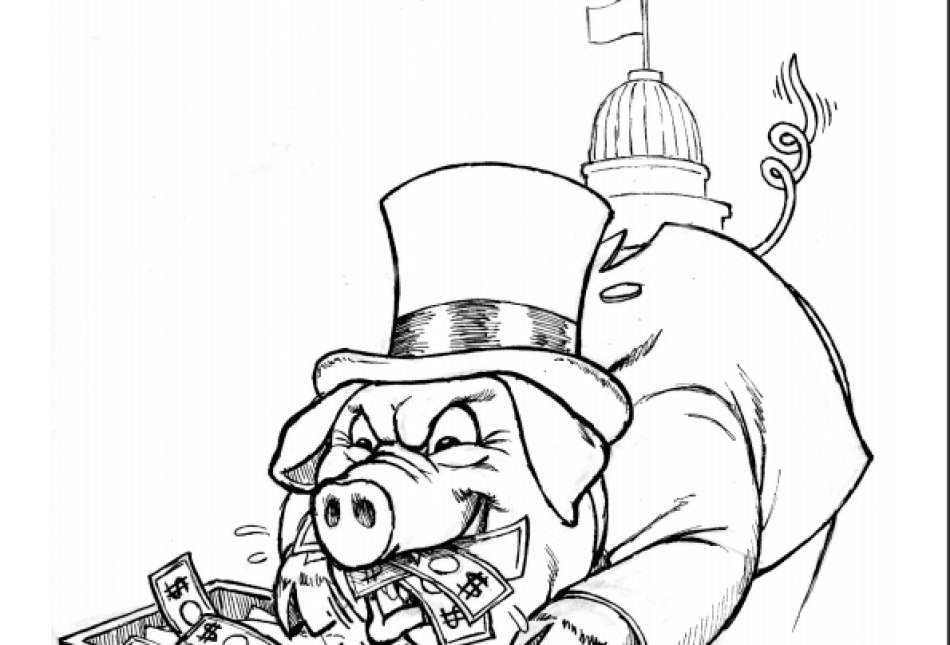

Local Taxman Has Gotten Out of Control

Local elected officials are on a roll. Bernalillo County’s recently passed $20 million tax increase for health care on top of a $20 million tax hike for the jail may be just the beginning.

Unless a majority of voters get to the polls Tuesday to reject additional tax increases for Albuquerque Public Schools and again in November to block the proposed quality-of-life tax, local governments will be taking even more of our hard-earned money.

An outside observer might assume these new taxes are necessary because revenues have been stagnant. That couldn’t be further from the truth. From fiscal 2004 to fiscal 2005, the county shows an 8.6 percent jump in revenue. That is the most recent data the county makes available.

The city of Albuquerque has also seen massive spending and revenue increases in recent years. In fact, between fiscal 2004 and fiscal 2006, spending grew by an annual average of 9.4 percent.

In fact, governments at all levels statewide have seen strong revenue growth for the last few years. Rather than asking taxpayers for even more money, some of these tax hikes could be avoided through wiser use of existing revenues.

On the Sept. 19 ballot, Albuquerque Public Schools is asking voters to raise their property taxes by 5.6 percent. The price tag of that tax hike will start at $351 million and rise over time with property values. The property-tax hike would amount to a $175 annual increase in property taxes on a $250,000 home.

Earlier this year, the city convinced local homebuilders to tack an additional $2,000 fee on to the price of all new homes, again to pay for public schools.

As if all of these tax hikes were not enough, come November, Bernalillo County voters will be asked once again to dig into their pockets to pay the taxman. Voters will then be deciding on a 3/16-cent “quality-of-life” gross-receipts-tax hike to benefit the arts, sciences and cultural programs.

If approved by voters, this tax would further increase the tax burden by another $30 million annually. If both the “quality-of-life” and the property-tax hike are approved, taxpayers in Albuquerque will see their tax burdens rise by $421 million just next year!

During 2006, city residents paid gross-receipts taxes at a rate of 6.875 percent. Come January, based on the health-care tax hikes alone, they will be paying 7 percent. The quality-of-life tax hike would further increase the rate to 7.19 percent.

County residents living outside the city limits would see the gross-receipts tax rate rise from 5.6875 to exactly 6 percent. Even at 7 percent, Albuquerque residents will face a rate higher than the average sales tax rate in all but 13 other states.

Even more problematic than the rate increases themselves is the fact that since New Mexico levies a gross-receipts tax— as opposed to a more limited tax on retail sales— consumers and small businesses will face an even higher price tag for a whole host of items that aren’t even taxed in other states.

Taxing services causes small businesses in the city (and county) to pay more for services that larger companies can perform in-house. A gross-receipts tax rate over 7 percent along with higher property-tax rates will definitely hurt the bottom lines of businesses and consumers alike.

The Albuquerque metropolitan area has gained a lot of attention in recent years from Forbes, Kiplinger’s and Entrepreneur Magazine. But if local tax rates continue their dramatic rise, hard-working, productive people will start looking elsewhere.

Our great weather and relaxed lifestyle are nice, but ultimately people want to enjoy the fruits of their labor. Both the city and county should have used existing resources more efficiently in order to avoid these unnecessary and economically harmful tax hikes.

Paul Gessing is president and Justin Smith is a policy analyst with the Rio Grande Foundation. The foundation is a nonpartisan research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility.