Time for Santa Feans to reject another tax hike

Santa Feans, this time the entire county, will soon be asked to vote on higher taxes (“County GRT vote quietly approaches,” Aug. 27). Wisely, city residents overwhelmingly rejected the costly and unfair sugary-drinks tax back in May, but that doesn’t mean that the folks arguing for higher taxes have any better arguments in favor of tax hikes than they did four months ago.

The proposal at hand is for a “modest” one-sixteenth-cent increase in the gross receipts tax, but this is on top of a recently adopted one-eighth-cent gross receipts tax hike in June that hasn’t taken effect yet. Yet, the county just raised the GRT by one-eighth of a cent back in 2015, and property taxes for the schools went up significantly back in 2014 and earlier this year.

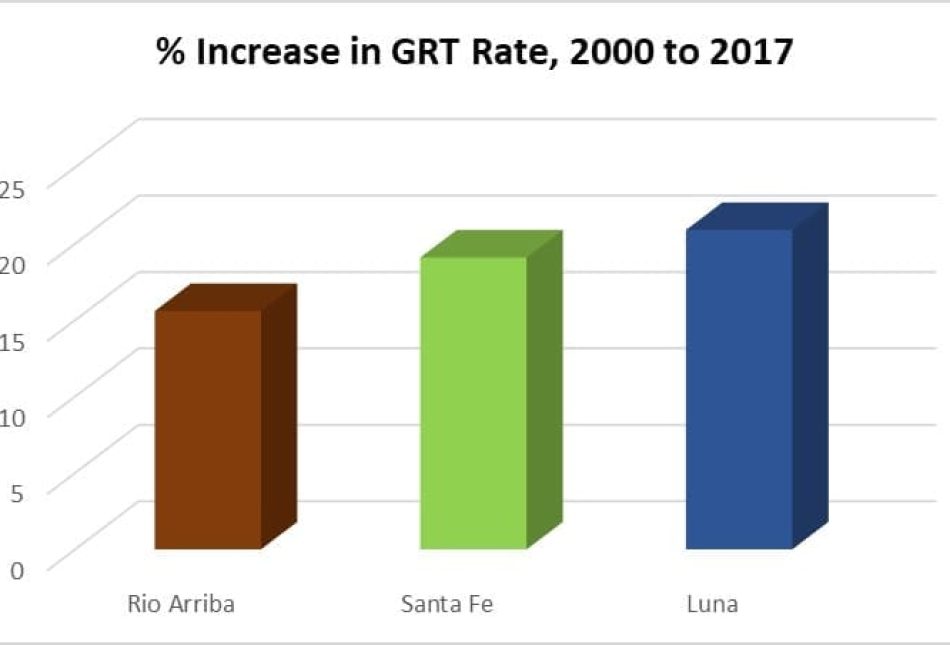

Speaking specifically about the gross receipts tax in the city of Santa Fe, since 2000 alone, the rate has risen by 29 percent, while the rate in the county has risen by 19 percent.

Santa Fe is a “progressive” city, and the members of the County Commission are all Democrats. President Donald Trump won just 20 percent of the vote in Santa Fe County.

Yet, with all that being said, the constant drumbeat of tax hikes will be far more difficult for middle-class and low-income residents to bear. We saw this dynamic in the soda-tax vote with low-income voters coming out strongly against the tax while the wealthiest enclaves showed greater support.

Like the soda tax, the gross receipts tax is considered “regressive” because the tax disproportionately sucks up a higher percentage of the earnings of those with lower incomes. Higher rates inflict even more pain.

The gross receipts tax also is the target of reform efforts in the Legislature because it uniquely hurts small businesses and entrepreneurs. If I hire a bookkeeper on contract (to take just one likely scenario) who works in New Mexico, I pay taxes. If I locate my business in another state or just hire a bookkeeper in Texas or another state, I don’t have to pay the tax. I can’t think of a better way to shift economic activity away from our state. Rising rates simply mean more economic damage.

While it’s true that the rate increases over the past 17 or so years have been driven by a variety of state, city and county forces, the fact is that rates have risen most for people who haven’t got the money or inclination to hire a lobbyist to get an exemption.

In fact, various industries have realized over time that the only way to do business in New Mexico is to hire lobbyists to get an exemption or some other favor under the gross receipts tax. These tax hikes are simply reverberations from former New Mexico Gov. Bill Richardson’s misguided decision to exempt groceries from taxation. This set off a chain of events including “hold-harmless” payments from the state to local governments, which are being phased out. It has been a messy process and New Mexico’s unemployment rate remains second highest in the nation.

So, what is there to do? Santa Fe County voters should reject higher taxes and instead tell their local officials to engage with lawmakers to push for state-level tax reforms that, if enacted, will reduce the gross receipts tax rate, eliminate “pyramiding” taxes paid on top of taxes, and eliminate the “Swiss cheese” exemptions and other provisions that have made their way into the gross receipts tax in recent years.

It is not an easy process, but raising the gross receipts tax and making Santa Fe County an even less attractive place to work and do business is not the answer.

Paul Gessing is the president of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, nonpartisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility.