Tax and Budget

post

Spending Will Trump Tax Reform

New Mexico’s Tax Commission wants to make the state’s tax system fair, simple, and efficient. That can be done.

But there’s another requisite for tax reform: the new tax system must deliver enough money to Santa Fe to pay for whatever the legislature and the governor want to spend. That’s asking the impossible.

New Mexico needs some way of controlling its budget, or tax reform will be out the window within two years. Since it’s obvious we can’t count on the state legislature or the governor to rein in spending, some stronger medicine is needed.

New Mexico’s state spending per capita has grown rapidly in recent years, more than six percent a year, and the future looks worse.

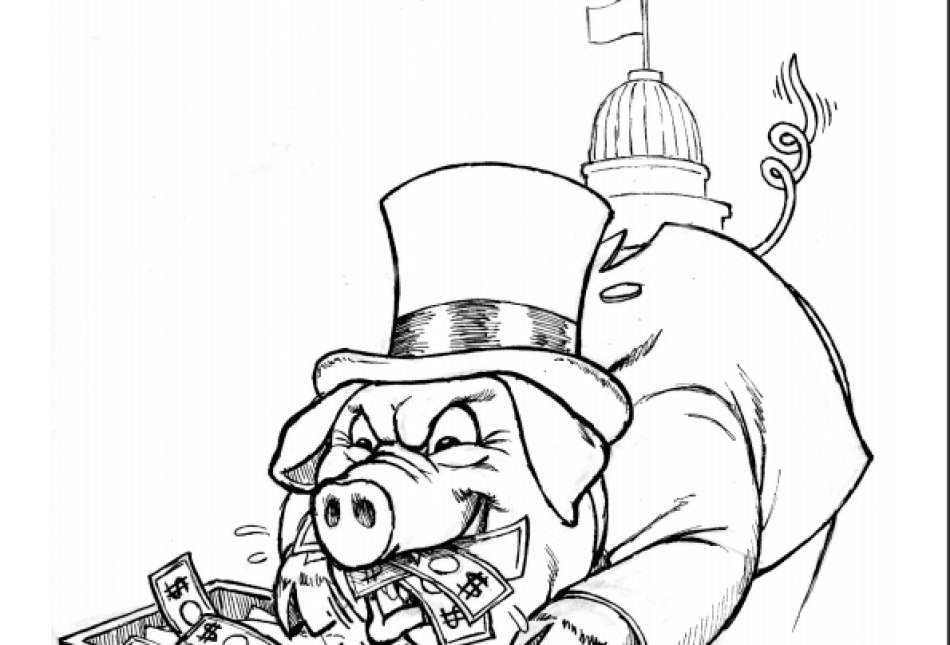

The legislature has increased the education budget substantially and probably will continue to do so. Virtually nothing has been done to restrain Medicaid costs, even though this gold plated program is paying medical bills of thousands of people who have access to company plans but opt for the nearly free and more generous Medicaid. Government employment growth shows no signs of slowing, and the ever-popular “pork” spending will keep expanding too.

Here’s what’s likely to happen: The tax commission will suggest a whole raft of reforms. Some will make good sense (like removing the gross receipts tax on medical services) while others will merely tinker at the margin, lowering one tax and raising another. In aggregate, they’ll recommend increasing taxes by about enough to cover this year’s looming budget deficit.

While this modest agenda is evolving, the steam roller of spending will flatten all the good intentions, as a new budget “crisis” looms next year and beyond. All of the proposed increases in taxes will be slurped up by spending growth.

The budget will balance for about one year, and then more tax increases will be needed. The legislature will throw out every tax-cutting reform in order to cover new budget-busting expenditures.

The dire results: State spending increases will undermine the only growth-oriented piece of legislation yet passed-the reduction in income tax rates. It is all but inevitable that these cuts will be rescinded, with dismal effects on the business climate. Just as now, New Mexico will be mired in a sluggish economy caused by its high taxes relative to those in neighboring states.

There is nationwide precedent for the budget crunch I predict. California’s disaster is infamous, and substantial problems have appeared in most other states. Even wealthy Virginia is being forced to cut big chunks from its budget. No substantial help from Washington should be expected, as the federal budget deficit is enormous. New Mexico’s crisis will be late in coming only because of Governor Johnson’s tightwad approach that led him to veto of so many spending bills.

So what’s to be done? Look one state to the north.

Colorado sets a magnificent example that New Mexico should follow. In 1992, Colorado voters passed the Taxpayer’s Bill of Rights (TABOR), a constitutional amendment that limits state government spending to population growth plus inflation and allows only those tax-rate increases that are approved by voters.

TABOR worked wonders for Colorado. In the previous decade, spending grew twice as fast as population-plus-inflation, while in the ten years after the amendment’s passage the two were about equal. This helped private sector employment to grow twice as fast as government jobs. Moreover, the surplus rebate mechanism returned about $3,200 to an average family of four between 1997 and 2001. Colorado now faces a budget deficit, but it’s solving the problem with spending cuts, not big tax increases, thanks to its TABOR.

Does New Mexico have the willpower to follow Colorado? If not, we’ll have a worse economic mess than any well-intentioned tax commission can ever solve.