Economy

post

Santa Fe’s ‘Living Wage’ Misguided

On June 24, a New Mexico District Court judge upheld Santa Fe’s “living wage” law. Businesses and their employees should appeal the judge’s ruling because the law will benefit a few workers but will overwhelm these benefits with costs that others would bear.

Santa Fe’s Living Wage Ordinance was enacted in 2002. It initially applied to city employees, employees of firms with service city contracts of $30,000 or more, and certain recipients of economic development assistance from the city. Now the city council has extended the ordinance to every business in town employing 25 employees or more.

Minimum wages would initially rise to $8.50 an hour, to $9.50 an hour in January 2006, and $10.50 in January 2008. For comparison, note that the federal law sets a minimum wage of $5.15 an hour, or $2.13 an hour for tipped employees. By contrast, the Santa Fe ordinance would boost the minimum wage for tipped employees to $5.50. Most of the unskilled workers in Santa Fe are in hotels, restaurants, shops, supermarkets and grocery stores.

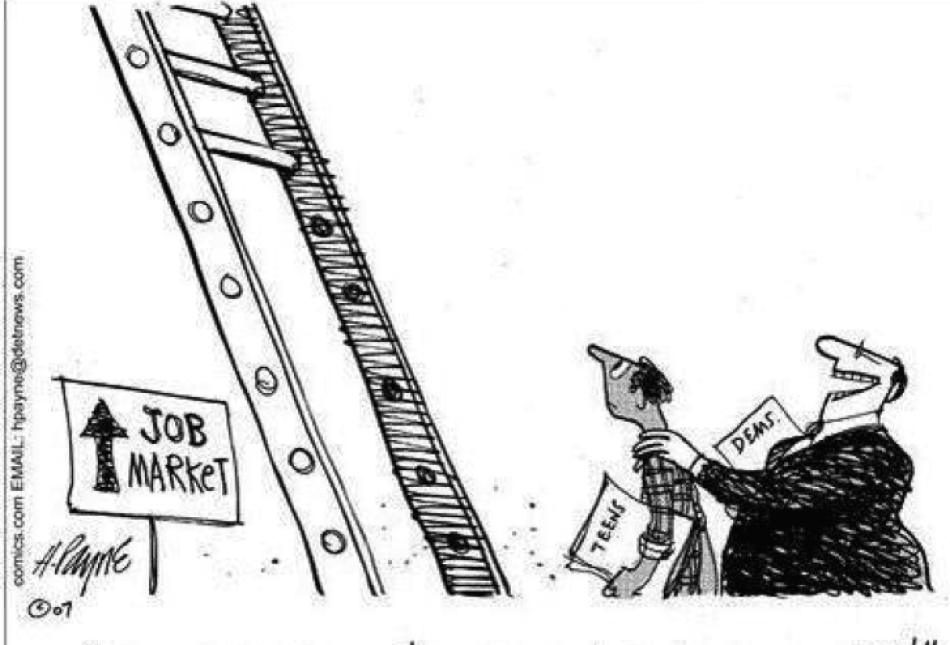

The major negative impact of minimum wage laws is unemployment among unskilled workers – mainly teenagers, women and minorities – leading to heavy economic losses to these groups. This has been documented many times for minimum wage laws at the national level.

These impacts are likely to be even greater for small towns that enact “living wage” laws because many firms can avoid the extra labor cost simply by moving to another town. Two factors will cause unemployment among the unskilled workers to rise:

- First, the substitution between labor and capital. Faced with a higher minimum wage rate, employers would invest in less labor-intensive machinery that would enable them to hire more-skilled workers at the expense of less-skilled workers.

- Second, the rise in the price of services rendered by the affected industries would drive up prices, thus inducing consumers to purchase less – resulting in worker layoffs. For example, higher prices charged by hotels would induce some opera fans to return to Albuquerque rather than spend the night in Santa Fe after the opera. Some number of tourists from around the country would change their plans too.

The smallest businesses aren’t covered by the new law, but some of those in the 25 to 100-employee range may not survive. For example, The Marketplace Natural Grocery in Santa Fe has some 80 full-time employees. Of those, the majority are clerks, stockers and baggers who earn less than the proposed “living wage.”

This small store faces competition from chain stores like Whole Foods and Wild Oats that could absorb temporary losses until they invested in labor-saving machinery. For their smaller competitors, the increase in labor costs might be fatal.

There will be other economic disruptions, stemming from poor targeting, that are less visible. For example, some firms might counteract the higher wage by reducing the fringe benefits they offer. Thus, the “living wage” in these cases would have no net benefit to workers. Indeed, since wages are taxable and fringe benefits aren’t, workers might well be made worse off. Other examples of poor targeting are tipped employees and employees from a family of two or more earners.

First, even with a minimum wage of $5.50, a tipped waiter may be earning something like $15 an hour. This tipped employee is likely not poor, just a student who earns some extra money during the summer that would help defray his tuition and room and board while attending college.

Second, poor targeting will increase the incomes of teenagers and unskilled women in two or three-earner families. The worst case scenario is that of a household of two wage-earners, where one member earns $40,000 annually and the other earns $7 an hour. Together they earn $54,560. Raising the minimum wage rate from $7 to $9.50 in 2006 would add $5,200 to their annual income.

The logic of the “living wage” or, more correctly, the mandatory minimum wages, is flawed. Basically, it is the philosophy that a government can force producers to pay employees more than the value of their contribution to production. Economic theory is very straightforward in this issue: If we want to raise the wages of unskilled laborers we should induce them to become more productive by acquiring more schooling and better skills – either on the job or at schools.

Gisser is UNM professor emeritus of economics and a senior fellow at the Rio Grande Foundation. Brown is a research director for the foundation.