Raise Tax Credit, Not Minimum Wage

The Republican Party is waking up from the Nov. 7 shock. In a moment of weakness the Republicans and moderate Democrats in Congress are about to get snookered into a grand deal of raising the mandated minimum wage. What a shame!

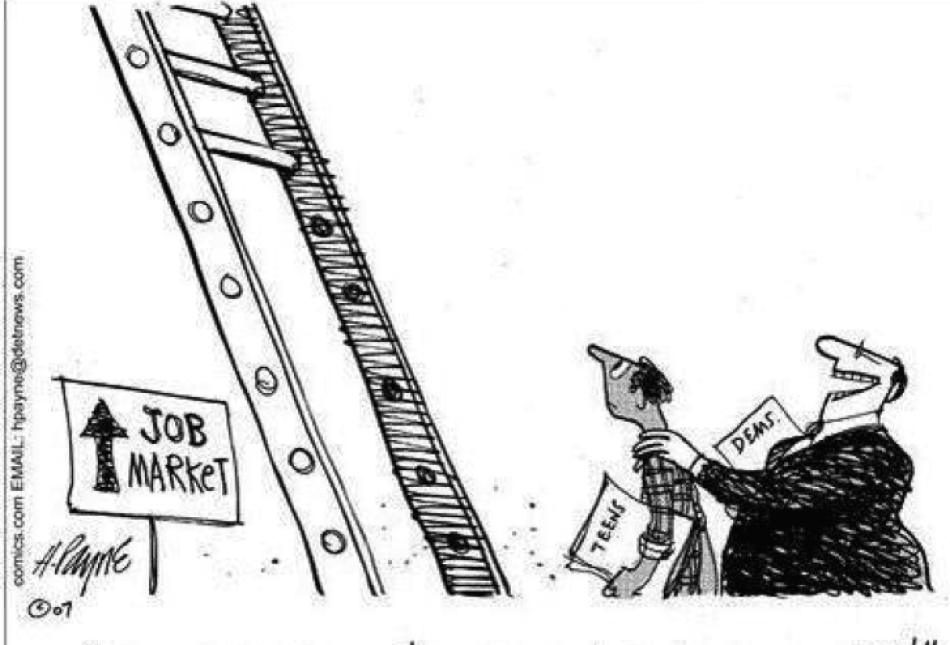

Back in 1938 Congress legislated a statutory minimum wage rate as part of the Fair Labor Standard Act. Since then, not much good has come out of it: Any time it has been set at a level exceeding the value of labor’s contribution to production, as confirmed by many empirical studies, unemployment— mainly among teenagers, women and minorities— has resulted.

Additionally, since the minimum wage law does not cover fringe benefits, to keep the cost of labor in line with labor productivity, employers cut back on various fringe benefits offered to unskilled labor. Medical insurance, on-the-job training and “free lunch” come to mind.

Although a worker may continue to work with reduced fringe benefits, his or her welfare diminishes because an option previously available no longer exists and also since wages are taxable and most fringe benefits are not.

And then, there is the issue of poor targeting that would increase the incomes of teenagers and unskilled labor in two- or three-earner families. Even if the mandated minimum wage were effective, it would increase income where there is no poverty. An illustration of the worst-case scenario of misguided targeting is that of a household of two wage earners, where one member earns $45,000 annually and the other earns $5.15 an hour. Assuming a work year of 2,080 hours, together they earn $55,712. Raising the minimum wage rate from $5.15 to $7.15 would add $4,160 to the household’s annual income. Note: The poverty line for a two-person household is $13,200.

The hysteria over the erosion of the real value of the minimum wage by 19.8 percent (from 1998 to 2005) is the driving force behind the movement to increase the minimum wage. Some would argue that it should be raised to $6.17 to adjust for the impact of inflation since 1998.

Others would reason that in 1969 the nominal minimum wage was set at $1.60. Since then the consumer price index rose 432 percent and accordingly in 2005 dollars the minimum wage in 1969 was $8.51— the highest since 1938. Hence, they claim, the minimum wage should be raised to a whopping $8.51

However, the best anti-poverty tool is the late Milton Friedman’s idea of negative income taxes, whereby the government pays income to the poor. Unlike minimum wages, negative income taxes target the poor precisely and hardly disrupt labor markets.

While it is true that negative income taxes contribute to the fiscal deficit, we should take into consideration that unskilled workers who lose their jobs in the wake of rising minimum wages relocate into the nonmarket where generous public welfare programs are available.

The Earned Income Tax Credit (EITC) program that was established in 1975 is in essence a federal-negative-income-tax program. An ideal legislation would be to abolish the mandatory minimum wage, and replace it with an expanded EITC. However, the minimum wage, like the medical-care tax advantages that were born of some misguided federal regulation during World War II, has become a sacred cow.

To illustrate EITC’s mechanism, consider a single low-income mother with two children. In 2006 EITC entitles her to a tax credit of 40 percent for every dollar earned up to $11,340, to a maximum of $4,536; it remains at this maximum level in the bracket from $11,340 to $14,810; thereafter EITC is reduced by about 21 cents for each additional dollar earned until it reaches zero at an income of $36,348.

If she earns the minimum wage of $5.15 an hour, her annual income is $10,712 (assuming 2080 working hours per annum) and her EITC is $4,285— 40 percent of her income. For comparison, her hourly EITC is $2.06.

Suppose the mother in our illustration is given the choice between increasing her minimum wage by an additional $2.06 an hour, or, alternatively, increasing her annual EITC by another $4,285. She should opt for the latter, which would increase her income without the risk of losing a fraction of her fringe benefits or even her job.

If our new congressional leaders, Republicans and moderate Democrats, sincerely want to fight poverty, they should leave the mandated federal minimum wage at $5.15 and expand EITC to help the poor.

Micha Gisser is professor emeritus of economics, University of New Mexico, and a senior fellow, Rio Grande Foundation.