Lujan Grisham’s GRT cut fails to address issues

The following appeared in Las Cruces Sun-News on Sunday, November 28, 2021.

For many years the Rio Grande Foundation has pushed the Legislature to take steps to address fundamental problems with the State’s gross receipts tax. We’ve regularly labeled it New Mexico’s “original sin” of economic policy due to the tremendous harm it does to New Mexico’s economy.

And, while we support ANY effort to lower tax burdens on New Mexicans, the Gov.’s plan for a small .25 percentage point reduction in the State’s GRT burden hardly makes up for recent increases. With a $2 billion budget surplus looming this January and the Senate Finance Committee Chair saying the Legislature has “more money than they know what to do with,” it is time to really reform the GRT, not provide an election year sop to struggling businesses and families.

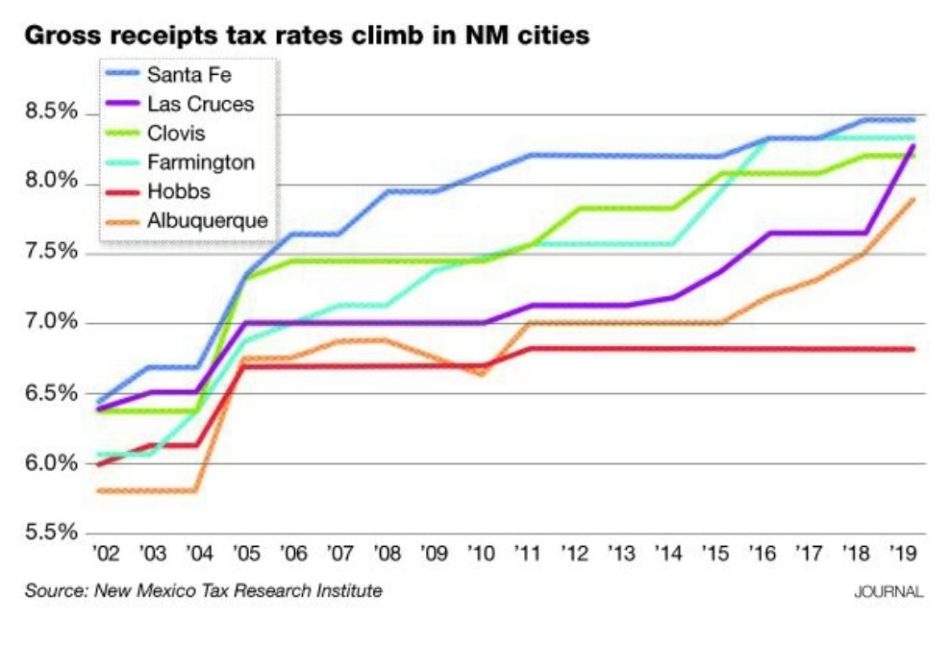

Currently, the City of Las Cruces GRT is 8.3125%. Back in 2010 that rate was “just” 7.0%. The Gov.’s reduction, if implemented, won’t even get the rate back to 8.0%. Las Cruces is not alone. GRT rates have risen dramatically over the last 20 years due to a combination of state and local policies.

But the most important problem with the GRT is its unfair treatment of small businesses. Accountants, bookkeepers, even medical professionals, and attorneys (and many others) all must charge this tax on top of the cost of their services. Alternatively, service providers located in other states do not have to charge the GRT. This makes New Mexico especially unattractive as a location for small businesses. And it is those small businesses that grow into tomorrow’s big businesses which can employee hundreds or even thousands of workers and boost state and local economies.

With the Legislature expected to convene in January with up to $2 billion in surplus revenues generated primarily from oil and gas, now is the time to focus on fundamental reform. According to the Gov. this tax cut will reduce revenues by $145 million annually. That’s a tiny fraction of the surplus. At a bare minimum proper GRT reform needs to eliminate the taxation of these business services. It will be easier to make the change when there is plenty of revenue available.

The GRT and much-needed reforms to it are not a partisan issue. Republican Jason Harper has introduced reform legislation in recent years with former Senate Finance Committee Chair, Democrat John Arthur Smith. More recently, powerful House Appropriations Committee Chair Democrat Rep. Patty Lundstrom told attendees of the New Mexico Oil and Gas Association (NMOGA) conference in October that “tax pyramiding” needed to be addressed by the Legislature in the upcoming session.

While taxing services is the fundamental problem with the GRT, there are others. Specifically, while the tax was originally conceived as being applied at VERY low rates and broadly, the political process has led to the current, sorry state of high rate, exemption-filled tax structure.

Special interests line up in Santa Fe to lobby for exemptions and deductions for their business or industry and the Legislature is more than happy to offer those exemptions. And, whether you support taxing groceries or not, the process of eliminating that tax has directly contributed to the massive rise in GRT rates in recent years.

In addition to addressing taxes on business inputs and services, the Legislature needs to put a stop to the special exemptions while also constraining the future ability of local governments to raise rates.

A tiny tax cut passed as we head into an election year with a massive budget service may or may not be good politics, but it certainly isn’t enough to address the fundamental problems with New Mexico’s GRT.

Paul Gessing is president of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, nonpartisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility