Incentives Not the Way To Go

Mayor Richard Berry has done a great job in very tough economic times for the city of Albuquerque. He is doing more with less than his predecessor and is tackling the public employee unions to drive efficiency in government.

Also, he has avoided hare-brained, taxpayer-financed schemes like trolleys and arenas that so entranced his predecessor but would have burdened taxpayers with decades of debt payments and higher taxes.

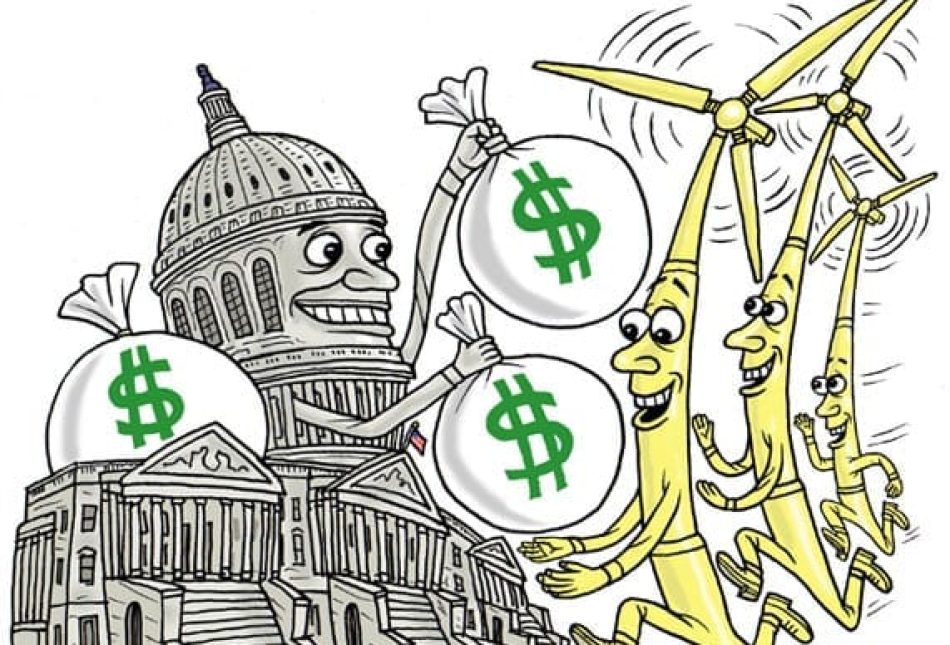

So, it is somewhat disappointing to hear the mayor, as he did in a recent speech, promote the use of “incentives” as a means of bringing business to town. He’s even commissioned a study on the topic.

Certainly, growing the economy and generating jobs is on the minds of politicians nationwide and Berry and Albuquerque’s City Council would be derelict if they were not concerned about these issues, but “incentives” should be avoided. It is good tax and budget policies that New Mexico and Albuquerque should be pursuing.

Incentives tend to be narrowly focused on one or two companies and are offered at the discretion of political leaders. Sound tax and budget policies are open to all comers and effectively alter the business climate for all businesses in a favorable way.

If New Mexico is going to become economically competitive with other states, there are two major policies that, if adopted, will do the trick. These are by no means the “only” policy changes that can turn around New Mexico’s economy, but they are big-picture reforms for which there are sound data.

The first is to eliminate New Mexico’s personal income tax. According to Arthur Laffer and Stephen Moore, “from 1998 to 2007, more than 1,100 people every day including Sundays and holidays moved from the nine highest income-tax states such as California, New Jersey, New York and Ohio and relocated mostly to the nine tax-haven states with no (state) income tax, including Florida, Nevada, New Hampshire and Texas.” In addition, they also found that over these same years the no-income tax states created 89 percent more jobs and had 32 percent faster personal income growth than their high-tax counterparts.

Gov. Bill Richardson got the ball rolling when he took New Mexico’s top income tax rate from 8.2 percent to 4.9 percent, but more needs to be done, especially since New Mexico has the robust gross receipts tax which is charged at high rates.

The push has been towards raising taxes and additional revenue in recent years, but some combination of spending restraint and added revenue could give policymakers the fiscal breathing room necessary to eliminate the personal income tax.

The second major reform is the adoption of “right to work” legislation. Simply put, these laws prohibit employers and unions from making membership in a union or payment of union dues a condition of employment. In other words, if you want to be in a union, you can, but you can’t be forced to be in a union, either.

According to economist Richard Vedder, both population and income growth have been significantly faster in the 22 states with right-to-work laws than in those states that allow forced-unionism. Texas, Oklahoma, Arizona and Utah all have right-to-work laws in place.

Any company, even a green-tech company like First Solar, which Mayor Berry believes we lost due to inadequate incentives, wants to pay market wages and reasonable benefits to their workers. Having right-to-work legislation in place makes this far more likely.

The list of other reforms that could be made includes improving our failing educational system (as the governor attempted this year), reforming our regulatory system and transforming our gross receipts tax into a straight sales tax. But, top priority should be given to eliminating the income tax and adopting right-to-work laws.

Economic development is tough, but Berry and the city should push the state Legislature for these big, real reforms, not limited “incentives” available to only the chosen few.

Paul Gessing is the President of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, non-partisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility.