Bernalillo County Voters Should be Skeptical of UNMH Mill Levy

Every eight years, University of New Mexico Hospital (UNMH) must ask Bernalillo County voters to renew the Hospital’s Mill Levy. Bernalillo County imposes a mill levy for the Hospital at a rate approximating 6.400 on both residential and non-residential property in the County. This money is used to fund Hospital operations. Initially, $95 million will be collected annually although the exact number will fluctuate based on property values and economic conditions in the County. The trend <em>should </em>be upwards, however.

<ul>

<li>As of June 2016, UNMH served <strong>6,812</strong> uninsured county residents. If that trajectory holds through December that would mean the Hospital will serve 13,624 uninsured patients in 2016.</li>

</ul>

In 2013, UNMH served <strong>approximately 27,000 county residents. </strong>UNMH is now serving less than half the uninsured county residents as they did in 2013.

New Mexicans are paying the bills for both the ObamaCare Medicaid expansion that is reducing those “uncompensated care” rates, but UNMH wants to continue taking hundreds of dollars from both commercial and residential property owners throughout Bernalillo County <strong><span style=”text-decoration: underline;”>for another eight years!</span></strong>

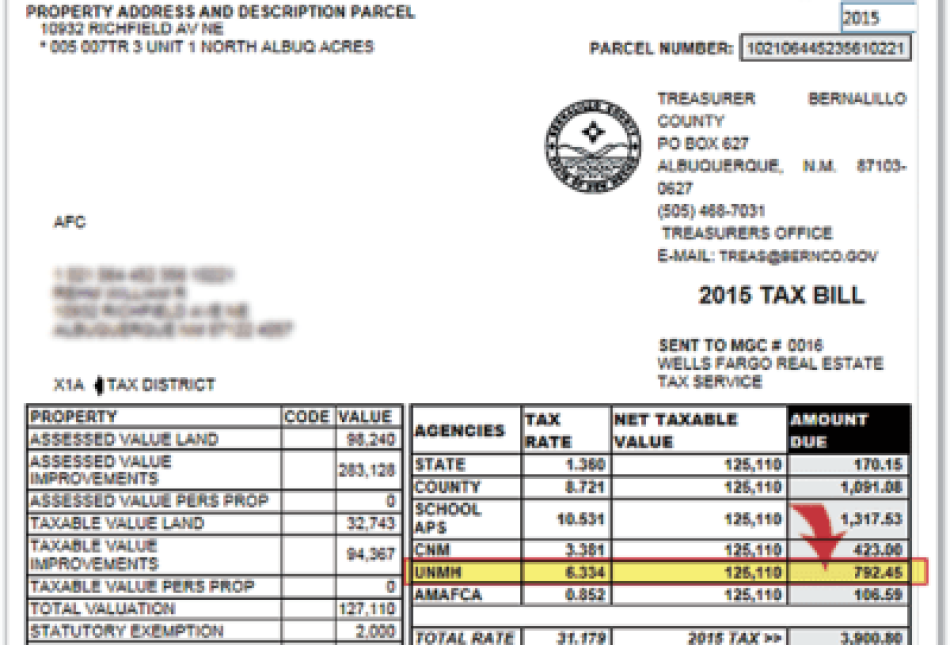

As the Rio Grande Foundation’s Paul Gessing argues <a href=”https://www.riograndefoundation.org/downloads/rgf_unmh_mill_levy.pdf”>in a new issue brief</a>, voters should consider sending UNMH “back to the drawing board” for a smaller mill levy that reflects the falling costs of uncompensated care. The image below illustrates how the current UNMH mill levy impacts at least one property owner’s tax bill.