Can Albuquerque avoid tax hikes? Yes, if reform is taken seriously

A PDF version of this document is available here. The full document upon which this brief is based can be found here.

Introduction

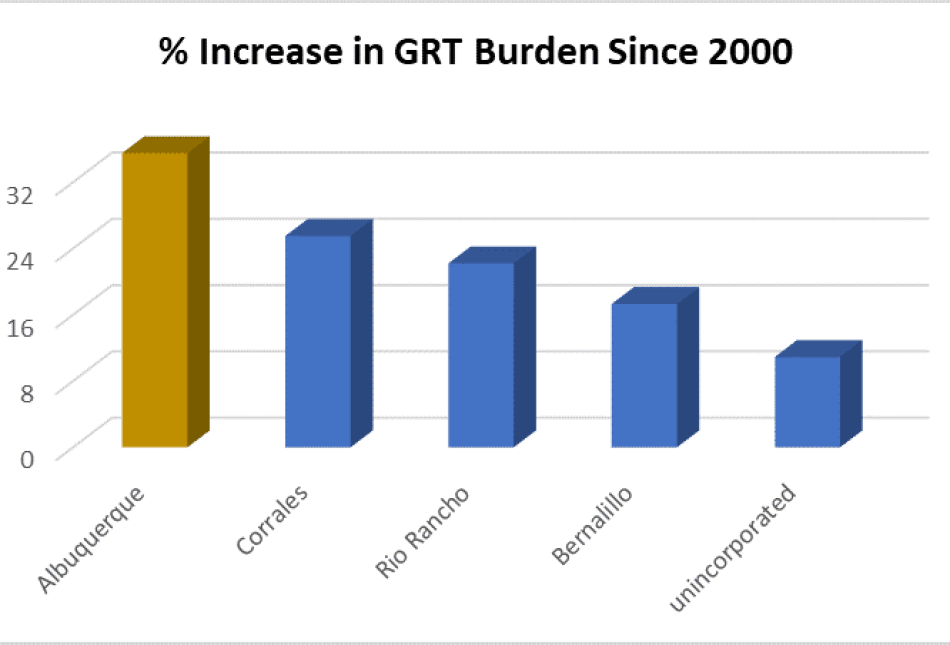

Albuquerque’s city councilors will soon vote on a hike in the city’s gross receipts tax – an increase that would make the GRT burden grow by a whopping 35.5 percent since 2000.1 But a close examination of city finances reveals that there are many opportunities for fiscal reforms that would eliminate the “need” to raise taxes.

Personnel

As the chart below indicates, employee-related costs comprise 49 percent of the Duke City’s budget. Thus, personnel expenditures offer the most opportunities for savings.

Source: FY 2017 Approved Budget, City of Albuquerque

● Eight out of every ten non-seasonal city employees are covered by collective-bargaining contracts.2 These union agreements regularly mandate wage increases regardless of employee performance, a practice that is all but unknown in the private sector.

● “Retiring” city employees are allowed to monetize unused paid leave – in 2016, the Albuquerque Journal reported: “It isn’t unusual for longtime city employees to retire and walk away with tens of thousands of dollars in pay for unused leave. Some payouts have approached $100,000 altogether.”3

● Employee contracts also require “longevity pay,” a benefit that North Carolina’s former governor noted private-sector workers “have never heard of.”4

● Taxpayers cover a significant share of the “employee” portion of pensions — in the 2016 fiscal year, the city was legally required to commit $33.3 million to retirement, but its actual payment was $60.2 million.5

Privatization and Competitive Contracting

The city has ample opportunities for privatization (the shifting of properties and facilities that do not perform core government services, do not generate sufficient revenue to cover costs, and are likely to draw interest from outside parties interested in pursuing profit and/or providing better-quality services) and outsourcing (procurement of public services from the best-quality, lowest-price providers, be they for-profit firms, existing departments/employees, or charitable entities). Examples include:

● The Albuquerque International Sunport and Double Eagle II Airport can be transferred to private enterprise under the federal government’s Airport Privatization Pilot Program.

● The Albuquerque Convention Center, a money-losing white elephant, should be offered to any buyer that has the potential to use the property to generate more jobs and greater tax revenue.

● Los Altos, Arroyo del Oso, Puerto del Sol, and Ladera Golf Courses and the Golf Center at Balloon Fiesta Park are marked by mismanagement, declining revenue, and rising expenses. They should be transferred to private management or sold off entirely.

● The Anderson-Abruzzo Albuquerque International Balloon Museum would best be administered by the Anderson-Abruzzo International Balloon Museum Foundation.

● Leaving aside the boondoggle that is “Albuquerque Rapid Transit,” the city’s bus system is losing ridership. It is time to work with nimble, efficient entrepreneurs to secure point-to-point transportation for disabled and/or low-income residents who need transportation. A new transit architecture, based on the principles and flexibility and affordability – and contracted out to capable, technologically savvy firms – should be adopted.

● Many New Mexico cities (including Rio Rancho, Los Ranchos de Albuquerque, Roswell, Taos, and Farmington) contract out solid waste, a reform that has been shown to reduce costs and improve safety. If the city’s Solid Waste Management Department cannot compete with a private firm, it should be eliminated.

Conclusion

With no net job growth in the past decade, Albuquerque cannot continue to raise taxes and hope that its economic development will ever rebound. City councilors should be exploring ways to right-size spending, not hike taxes on individuals, families, and business still struggling to recover from the Great Recession.

1. D. Dowd Muska, “The Tax Man Stalks ABQ,” Errors of Enchantment (Rio Grande Foundation blog), February 20, 2018.

2. Email from Alan Green, Employment Division Manager, Human Resources Department, City of Albuquerque, July 6, 2017.

3. Dan McKay, “Retiring aviation police chief to get $130,000 in paid leave, unused time off,” Albuquerque Journal, October 17, 2016.

4. Gary D. Robertson, “As expected, McCrory signs budget bill,” Associated Press, August 7, 2014.

5. Comprehensive Annual Financial Report, City of Albuquerque, Year Ended June 30, 2016.