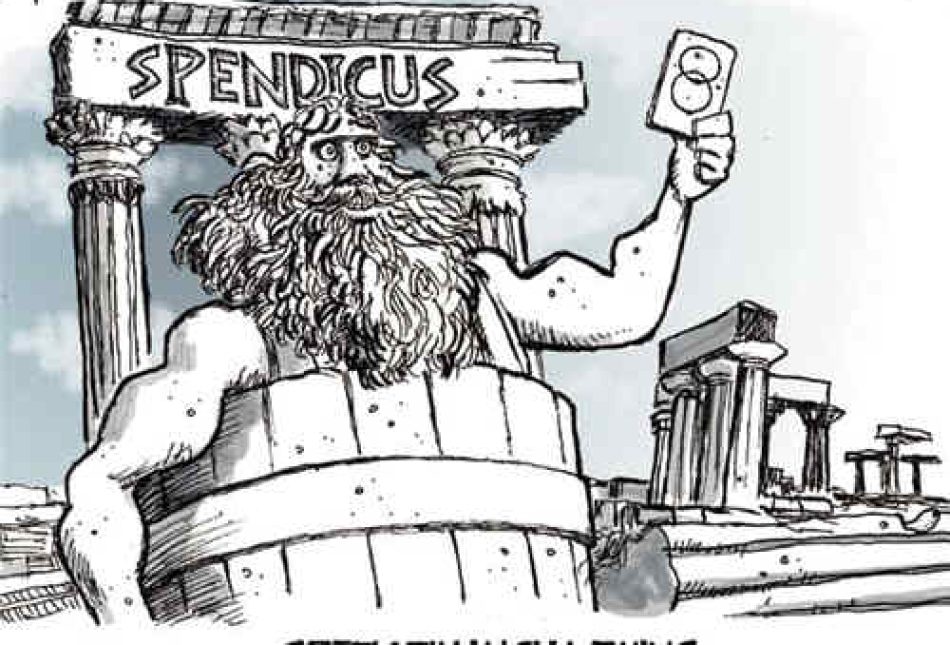

Stimulus Plan too Big, too Late to Help

The economic downturn that started last year was only the beginning of trouble. At first, it seemed to be a typical business cycle, curable by traditional economic medicine — deficit spending. No need to worry about the economy, people thought. Wise policymakers can fix recessions with deficit spending that “stimulates” the economy back to full employment. That’s the theory, anyway.

Despite huge federal budget deficits, unemployment keeps rising and key industries crumble. So why are we in such a mess?

The deficit treatment is essentially what John Maynard Keynes recommended in the 1930s, during the Great Depression, and though his theories have been modified over the years, they are still the guiding light for anti-depression policy. According to this theory, more government spending will fill the gap caused by the drop in private spending.

The huge sum of $787 billion has been allocated to spending on highway and bridge construction; reimbursing states for Medicare overspending; and one-time handouts to everybody. The spending on a mishmash of infrastructures will extend over years and will continue after the economy has returned to full employment.

Estimates show that only about 25 percent of the total stimulus will be spent during 2009 — the crucial year. Equally important, renowned economists Milton Friedman and Franco Modigliani showed that transitory components of consumptions — e.g. the stimulus handouts — contribute very little to consumers’ spending. Additionally spending was immediately politicized, with billions going to long-term boondoggles with no discernible “stimulation.” In other words, policymakers, with their own agendas, have loused things up.

Another obvious mistake was in the scope and timing of the federal spending barrage — too big and too late. Consider this: According to the non-partisan Congressional Budget Office (CBO) from 2003 to 2007 — in the wake of the Bush tax cut — the federal deficit fell from 3.5 to 1.2 percent of GDP. For historic perspective, the average deficit as percentage of GDP for 1962-2007 is 2.2 percent. Due to the mini-stimulus in the summer of 2008, in that year the deficit reached a level of 3.2 percent. But, predicts the CBO, the massive Obama stimulus ($787 billion) coupled to his 2009 omnibus measure ($410 billion) and colossal expected budget (some $3.5 trillion for 2010) will lead to an unbelievable budget deficit of 13 percent of GDP in 2009, falling to 3.9 percent in 2013 and rising to 5.5 percent in 2019. In 2008 the federal debt held by the public amounted to 40.8 percent of GDP; close enough to the average of 36.1 percent for the period 1962-2008. In 2019 the federal debt is expected to double to an unsustainable level of 81.7 percent of GDP — a level not seen since the end of World War II. Interest on this huge debt is estimated to exceed $800 billion a year.

A major reason for the expected rise in the deficit from 2013 to 2019 is the super-costly health-care reform that, if passed by the Congress, will somehow culminate in a single-payer system that most Americans do not want. (The president intends to cover this $1.5-trillion plan with heavy taxes imposed through a “cap and trade” energy plan and by exacting from pharmaceutical and hospital executives promises to cut costs by billions of dollars. Like the stimulus, these promises are a mirage from dreamland.

As is usually the case with efforts to stimulate the economy, the injections come too late, when the economy is recovering on its own. Of course, politicians (mainly the Democrats who jammed this fiscal monster through Congress) will rush to claim credit.

An important lesson from economics: The huge scale of the Obama bailout and budget cannot be financed by taxes alone, though tax rates are sure to rise sharply. Budget deficits also will be financed by borrowing from the public, foreign investors, and the Federal Reserve.

Perhaps, after energy taxes and “stealth” care, the worst policy response is the incursion of governmental control into the private sector. Every firm that has taken federal money has soon found itself with the government’s cold, heavy hand shoving it around. “Give us your plan,” congressmen demanded of the automakers. But Congress seemingly has no plan for the industry, other than to force automakers to produce cars that consumers don’t want to buy. We taxpayers are likely to find ourselves in the auto business, saddled forever with demands for more subsidies.

Finally, the Fed, by injecting liquidity into the economy, and not the president and his supporters in Congress, will win the war against the recession. We believe the economy will recover before too long. But serious and permanent damage will have been done in the name of economic stimulation.

Ken Brown, PhD is director of research and Micha Gisser, PhD is a senior fellow, with the Rio Grande Foundation; a non-partisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility.